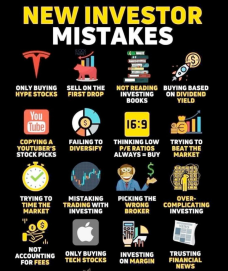

New investors always get wrapped up in the BS that Wall Street sells. This has been going on since the stock market was first established under the Buttonwood tree on May 17, 1792. It's made a lot of brokers rich and "investors" and speculators poor.

“Those who don't know history are bound to repeat it.”

Error #1 - Investing in hype stocks.

- Just because you love a company's service doesn't make them a good investment. I love Uber and Lyft for the service they provide, but will they ever make money on their service, unlikely.

- Wall Street hypes IPO's to get the really great profit margin they get for selling them. They don't want to be left holding the "hot potato" as it grows cold.! Most IPO’s fall from their initial offering price. After all, Wall Street is selling them at the top price they can possibly get.

- If a company is being hyped, everyone knows about them. There will be no way to get a deal with the crowd in a frenzy.

- You could be buying the next Amazon. If you think you are going to be that lucky, you might as well buy a lottery ticket at your local convenience store and only have to wait till they read the numbers that night.

- The hype is usually vastly overdone. Everyone got excited about ChatGBT, Barron’s had an article about them last weekend. The creator of ChatGBT said after running it 100 times, people would easily see it isn’t “the fountain of youth”.

Be careful out there and remember that Wall Street doesn’t make their money by investing…. They make their money by SELLING!

Be smart, be well-read, be aware and be successful.

“An IPO is like a negotiated transaction – the seller chooses when to come public – and it’s unlikely to be a time that’s favourable to you.”

— Warren Buffett