People naturally have a tendency to get excited about a stock. Instead of viewing the stock from a balanced perspective, they tend to exclusively focus on a stock’s upside and ignore the downside. At other times, their emphasis is exclusively on the downside while they totally forget about the upside.

Stocks are very much like people. Everyone has their good attributes, but they also have some bad attributes. A person is the sum of the bad and the good. The key point is that both sides are present at the same time.

Good stock analysis is understanding both the good and bad characteristics of a company. No company, like no person, is just all bad or all good. Evaluating a stock is looking at the aggregate positive and negative characteristics, weighing them out and deciding if the scale tips to the positive.

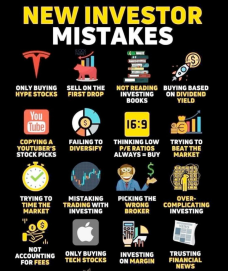

Often, new investors will focus on what they see as the positive and give it much more weight than the negative. They may be totally blind to the stock having ANY negatives. The result is they may put all their money on a SINGLE stock.

Having a portfolio being a single stock can be fantastic or a disaster depending on what the future holds. While such as strategy can be great when it’s good, it can decimate capital when that holding has swift and dire problems. Therefore, it is always good to have diversification

Points to keep in mind about diversification

- Even professional investors have many bad stock selections. Mistakes are how people learn. The investment manager will not tell you this because their potential clients have behavioral biases to not go with an investment manager who has had bad picks. The key for the manager is to have more good picks than bad. Diversification helps to protect the manager from themselves.

- Most of the statistical benefit of diversification are achieved with 10 stocks. Fifty stocks are not needed to achieve the lion share of diversification benefits.

- While diversification protects from the downside, it also “water downs” the potential rise on the upside. Think of this analogy. Mounting climbing is a dangerous sport. Using ropes and carabiners make it significantly safer (diversification) while free climbing makes it much more exhilarating and faster (non-diversified). The downside of free climbing is a serious impediment as you could die (be financially ruined).

- Some major investors’ styles are non-diversified, say just owning 6 stocks. But, these are usually investors who know the risks of their style, who have been investing for decades and have analyzed their selections to the n’th degree. Only a fraction of people are successful doing this, but that fraction could change to the negative side if something changed abruptly. The unexpected happens all the time in investing!

So, be smart and diversify. While it is a fantasy to make a lot of money quick, the result of not diversifying is financial disaster most often. Bad picks are alleviated by diversifying. The critical point is to “keep in the game” long term. If you wipe out, you are OUT OF THE GAME! Don’t do it.

Be smart, be well-read, be aware and be successful.

"Buying a company without having sufficient knowledge of it may be even more dangerous than having inadequate diversification “

- Philip Fisher