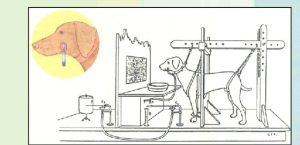

My biggest winners in stocks have dropped in price before they really took off. This is counter intuitive, but this has been my experience. With computers now days, everyone is like Pavlov's dogs. The bell rings (stock is bought) and the dog salivates (stock goes up). Stocks don't work that way. If you believe that train of thought, I wouldn't recommend buying equities. It will be a sad experience. Those types of folks are out of the stock when it starts to pay off. Often times, they sell at lows. Don't let this be you.

The movement of the stock market is often random in the short term. When I refer to the short term, I am talking anything less than a few months. When I am interested in a stock, I'm looking at a lot of fundamentals. I evaluate those fundamentals relative to the equity's stock price over 6 months, 1 year and 5 years. Anything less than that is just noise.

Patience is a virtue. It is critical to have patience in equity investing. Without patience, people sell too early. It also results in paying too much because they didn't wait for the "right" price. Lack of patience is a significant impairment when it comes to stock market investing. It is why the path of equity investing is strewn with those who have shrunk their wealth.

This is not to say that some selections do not meet expectations over time. Renowned investors such as Buffett, Lynch, Munger, Dalio, Tepper, Templeton, Neff, etc. readily admit that not all ideas work out. But those investors make more right choices than not.

Remember to be patient at all times. It can be trying at times. Don't let emotions get the best of you.

Be smart, be well-read, be aware and be successful.

Warren Buffett quotes paint him as a man who is patient with his decision-making, thorough in his evaluations and earnest in his beliefs. “You only have to do a very few things right in your life so long as you don’t do too many things wrong.” — Warren Buffett