If you’re a finance person, you might recall the academic way of evaluating projects given cash flows and the cost of capital. While I have never seen strict application of this, it provides great logic. If the cost of capital is low enough, you do a lot of projects that you normally wouldn’t do.

The cost of capital has been so low for so long and investors were groveling to find returns for an economy awash in cash. That means a lot of ideas got implemented. Many, if not most, were destined for failure.

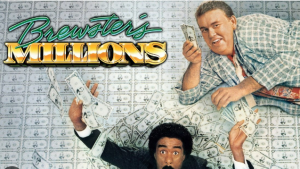

I like to think of it like this. Suppose you worked for 30 years to build a 5 million nest egg. The cost of that was busting your ass for 30 years and it was difficult. As a result, you are likely going to be careful with how you use it. On the other hand, if you inherit 5 million nest egg from a long lost uncle, the cost of it was virtually nothing – sort of like winning the lottery. You are likely to spend much of it quickly because it is “free money”.

We’ve been in a lottery economy for a very long time. Much VC and IPO capital has gone to businesses that lose money year after year. Often, the rate of losing money grows year by year. Sure, you’re likely not going to earn money in a new venture in less than three years, but should you wait 7 to 10 years or more to at least break even?

Those were the days my friend (Sounds like a song, huh?). They are gone. Let the bankruptcies begin!

Be smart, be well-read, be aware and be successful.

“Ideas are easy. Implementation is hard.”