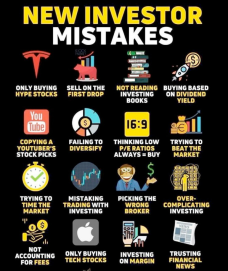

Many new investors get interested in stocks as they hear about the exciting stocks from the news and their friends. While it is always fun to follow what goes on in the markets and have stuff to talk to other people about, the excitement stocks can be very volatile. In the current market, tech stocks are the excitement stocks. Given this, many new investors will focus on only buying tech stocks.

Personally, I like and enjoy boring (Just for stocks, not other parts of my life!). That doesn’t mean I only own boring stocks. I own Nvida, Apple and AMAT, but I purchased them when the overall market couldn’t give a damn about them. They were basically on sale.

When tech stocks first came in in the 1950’s , there was lots of excitement about tech and prices went through the roof. In the end, most of those high flying tech companies crashed and burned. The same thing happened in the dot com era. People were paying exorbitant prices for companies who only had “ideas” or “concepts” that were burning through cash like a “one legged man in an ass kicking contest” (I stole that from Charlie Munger!).

So here we are again and lots of folks are excited, no ecstatic, about tech stocks.

Like they used to say about drugs, just say NO! Remember that boring can be beautiful!

Be smart, be well-read, be aware and be successful.

“Bull markets don’t arise out of thin air. The winners in each bull market are winners for the simple reason that a grain of truth underlies their gains. However, the bullishness I’ve described above tends to exaggerate the merits and pushes security prices to levels that are excessive and thus vulnerable. And the upward swing doesn’t last forever.”

-Howard Marks