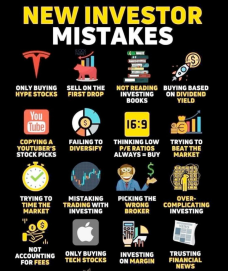

This is a rooky mistake. Buying on margin is borrowing money from someone else to invest.

Margin is enticing because the “investor” can use someone else’s money to make money for themselves. The “investor” may not have very much money, so they borrow funds to get the capital to invest. It sounds great when you look at the upsides of such an approach.

Most people have a tendency to excessively focus on either the positives or the negatives with an investment. Positives and negatives are ALWAYS THERE with ANY investment. Our minds tend to devalue one of them and overvalue another.

Those who invest on margin have a tendency to overvalue the idea of making money with someone else’s money. Because the amount of their own money that is “invested” is small relative to the buying power of their money plus the borrowed funds, they can get great returns on their money – if the market mores favorably for their investment.

The downside of margin is that the “investor” can lose their own funds much faster when buying on margin. Another side of margin is that there is an interest cost for borrowing those funds. As time goes on, the interest cost of those borrowed funds grows. So, it is important to be right on the investment and be right in a short period of time since the meter is running!

This is one of the most enticing “get rich quick” ideas, but most people investing on margin, just lose their money.

Be smart, be well-read, be aware and be successful.

“I think I am safe in asserting that the margin trader, speculator, gambler, or whatever you choose to designate the average man who goes to Wall Street after easy money, does not lose money when he sells. He loses it when he buys.”

— Edwin Lefevre