Investing books allow us to learn vicariously. If we had to learn everything on our own, we would probably suffer great losses before achieving any gains.

The books on investing are endless, but some are better than others. A few of my favorites are:

- One Up On Wall Street – Peter Lynch

- The Intelligent Investor - Benjamin Graham

- Securities Analysis – Graham and Dodd

- The Most Important Thing – Howard Marks

- Mastering the Market Cycle – Howard Marks

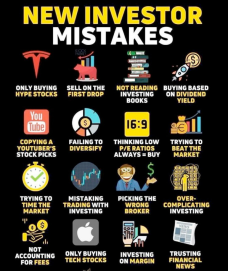

Don’t try to invest exactly like some famous investor. Develop your own style, but first you have to get some perspective by reading books by people who have been very successful.

I’m a value guy which generally means I look for bargains and hold them for a very long time. But there are many different types of value investors out there. There also is growth investing and many different variations of growth investing. The point is to get perspective by reading many books and deciding what your style is.

Error #3 – Not reading Investment Books

- Some people think Warren Buffett trades all day long. They would be wrong. By his own admission he spends most of his day in his office JUST READING. He has two portfolio managers who work for him. Buffett, unlike many other investment managers, encourages his portfolio managers to spend most of their time JUST READING.

- Usually older guys (70 years plus) who have been very successful in investing, get to a point where they want to pass on their knowledge and they write books. Most successful investors have been doing it for a long time. Take advantage of their need to enlighten the next generation of successful investors.

- Reading books enables the investor to get many perspectives and develop their unique style. Following someone else’s style in lock step isn’t the way to go because lots of people are emulating that style which means it loses effectiveness.

- Education does not have to be formal to be successful in investments, but you have to be well read. You also have to be a lifelong learner. There are lots of folks out there without CFA charters and other professional credentials who can run circles around those folks. RIF – Reading is fundamental!

Be smart, be well-read, be aware and be successful.

When asked how to get smarter, Buffett once held up stacks of paper and said, “Read 500 pages like this every week. That's how knowledge builds up, like compound interest.” All of us can build our knowledge, but most of us won't put in the effort. “Go to bed smarter than when you woke up.”