People who are relatively new to investing often look for high dividend yields. While a high dividend yield can be a favorable attribute, it can also indicate serious problems.

A dividend yield is simply the annual dividend divided by the current stock price. It is one simple metric that can be used in conjunction with other metrics to assess conditions, but to use it by itself is questionable and can be dangerous to your financial health.

Consider this, if a doctor takes your temperature and it is high, does this mean that you are sick? What if you just finished running? That would be a normal measurement, but under different circumstances it might be because you are sick. A prudent doctor would likely triangulate multiple metrics – blood pressure, a throat culture, a patient’s demeanor, a physical exam, etc.

A doctor doesn’t rely on a single metric to assess a patient’s condition. An investor should also triangulate multiple metrics to assess a stock purchase.

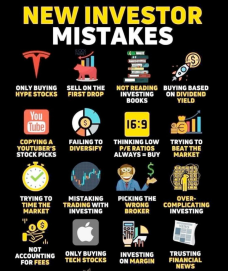

Error #4 – Investing based on dividend yield.

- When a company is mature and not growing their earnings much, they often pay out a substantial portion of their earnings. This is because management feels that there aren’t many opportunities to pursue projects that provide returns that are higher than their cost of capital (equity and debt). These companies can be good for steady but slightly increasing dividends. They are sort of bond like.

- Sometimes with high dividend yields, the market is questioning the viability of a company to pay a continued dividend. The market indicates this by pushing the company’s stock price lower. This is where the dividend yield can be high. But should the company actually cut their dividend, you lose the high dividend and maybe end up with no dividend at all. Plus, the stock price can fall even lower. Worse case is that you lose the income from the dividend AND you lose because the stock price falls significantly. Not good!

- While a high dividend yield can be a really great benefit, it usually requires deep analysis on the company’s business and markets and it’s financial metrics. To get these high yields safely is possible but it requires a lot of digging. And, a favorable conclusion needs to be right.

- Often when something looks too good to be true, it is!

Be smart, be well-read, be aware and be successful.

“Reaching for yield is really stupid. But it is very human.”

-Warren Buffett