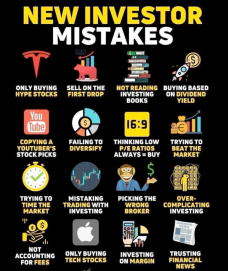

Using YouTube for stock picks is much the same as me trying to fix things around my house using YouTube. Some people on YouTube know what they are talking about and others have no idea. How do you know if the YouTuber has any idea about investing in stocks?

Even if the YouTuber’s stock selections are really good, they are out there for all to see in plain sight. So, if everyone sees the picks, it’s likely that many people are acting upon them. Whenever everyone knows something, it’s hard to buy something at a good price because the informational advantage is competed away.

Suppose you read something in a well-regarded financial publication like Barrons. If you are going to act on that information on Monday morning, you would be competing with many others who are also looking to gain an edge on Monday morning. At least Barron’s is likely to be credible. The YouTuber may or may not be credible.

Spending time to read up on a stock from multiple resources helps you to develop a feel for the stock. With 5 to 10 different resources you may get a good idea on the prospects for a stock, but investing in a stock without triangulating information from multiple sources is likely to produce poor results – possibly losses.

If it is too easy to pick stocks because some wide open source just gave them to you, you can bet that those picks are unlikely to serve you well.

YouTube would serve you better with a YouTuber who is not providing specific stocks but providing a paradigm for selecting stocks.

Be smart, be well-read, be aware and be successful.

"Risk comes from not knowing what you are doing."

-Warren Buffett