New investors often think anything but a continuous rise in a stock is a reason for selling a stock. Everyone of my best stocks has had some down periods, often for extended time periods. But, in the long-term, those stocks have risen way more than 10 times over.

“A tenbagger is an investment that appreciates in value 10 times its initial purchase price. The term “tenbagger” was coined by legendary fund manager Peter Lynch in his book One Up On Wall Street.”

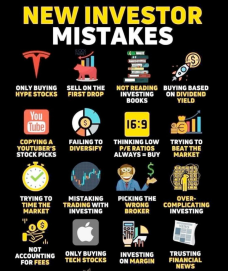

Error #2 - Selling on First Drop.

- People who sell on the first drop usually hold stocks less than a year. Selling within a year, subjects the seller to much higher tax rates. If held over a year, the seller pays long-term capital gain taxes at a much lower rate.

- Most of the time, the big gains in stocks are made holding for the long-term. Sure, short-term large gains can be made, but they are very rare. Everyone's dream is to get huge gains in only a short period of time. Suppose you did get a really huge short term gain. The tax man will eat up all as much as 1/3 of that hard earned return in ordinary taxes. Considering that huge short-term gains don't come very often, the government taking 1/3 of it is a "slap in the face".

- People associate the market's moves with the idea that it knows something. No one knows the short-term future. That's why the market often moves in erratic ways. Now if no one person can accurately predict the future, why would the collective opinions of many (the market) be any more correct?

Be careful out there and remember that Wall Street doesn’t make their money by investing…. They make their money by SELLING and HOLDING your assets WHILE CHARGING you fees!

Be smart, be well-read, be aware and be successful.

“Waiting helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

Charlie Munger