Many people look at investing as an exciting activity. It can be exciting at times, but usually it is rather boring and inactive – much akin to watching paint dry.

The financial news programs have a lot to do with driving excitement into investment activity as they try to incite or, better said, excite their viewership. If people did half of the stuff they recommend, they would be stressed out, spent out and flat broke. I’ve found that I can take only a few minutes of financial news programs each day. There are as many different opinions on the news as there are people.

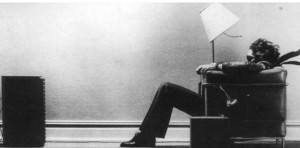

The deluge of data we all get daily gives us a false sense of security. Usually, too much data is exactly that, too much data. Good investment decisions require concrete and good data, but not too much data. From there, it is important to think about the data from multiple angles and add our own personal experiences and knowledge to the mix. But, to continually absorb more data, more opinions and other’s insights only clouds our thoughts and precludes us from making well thought out decisions.

Be smart, be well-read, be aware and be successful.

"Information is not knowledge. The only source of knowledge is experience."

- Albert Einstein

“We both (Charlie Munger and Warren Buffett) insist on a lot of time being available almost every day to just sit and think. That is very uncommon in American business. We read and think.”

- Charles T. Munger