Investing solely on the basis low P/E’s is much like chasing high dividend yields. Low P/E’s can be a favorable attribute, but without triangulating it with other metrics and information, using it can be financially dangerous.

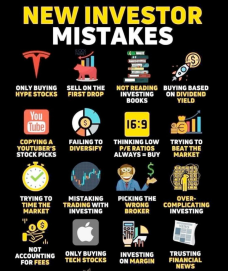

When investing, exclusively relying on a single metric is dangerous practice. Like a doctor assessing a patient’s condition, it is important to review multiple metrics to make a diagnosis.

There are a lot of reasons why a company may have a low P/E. Here are just a few them:

- In cyclical industries, a company may be at the top of their operating cycle. This means earnings are the highest the company is going to get in the current cycle. The stock price is low compared to the earnings (low P/E) because investors know this and don’t want to base owning the company on the company’s recent most favorable earnings.

- P/E’s can be low because a company’s earnings could have a long-term trend of not growing. P/E’s usually reflect the growth prospects for a company.

- P/E’s can be low because a company has had a significant one-time gain which is unlikely to be repeated.

- P/E’s can be low because the company or industry is temporarily out of favor by the market.

There are many reasons why a company could have a low P/E. Before jumping to the conclusion that it is a good stock purchase, it is essential that a number other items are researched and assessed, such as the economics of the business, recent earnings, earnings trends, significant events, etc.

While P/E’s can be an indication of a buying opportunity, there are many other things that a low P/E can be indicative of. It is important to think of a low P/E as just a starting point for more in-depth analysis.

Be smart, be well-read, be aware and be successful.

“Price is what you pay. Value is what you get.”

- Warren Buffett